AI software is a major growth industry. Tractica predicts that by 2025 it will be worth $118.6 billion dollars.

This growth is largely being driven by the increase in the usage of cloud-based services and applications.

The rise in the connected device market, investments in 5G and the emergence of intelligent virtual assistants are also helping to fuel the growth.

In the finance and banking sector, the adoption of AI has a number of benefits. As we will see from the examples in this article, AI software can enable banks to make the most of unstructured data.

This can help to build better, more rewarding relationships with clients in front office conversational banking scenarios.

As well as powering chatbots AI adoption can also help to improve workflow and aid regulatory compliance.

It is also helping to optimize workflow and save costs in anti-fraud (middle office) and underwriting (back office) processes.

An OpenText survey has revealed that 80% of banks are aware of the potential benefits of AI software.

Many of these banks are planning or have adopted some form of AI software or AI-powered solutions.

Ever wondered which major bank is using which AI software?

This research is the most comprehensive report of banks implementing third-party AI software and not their own in house AI software or investment in AI start-ups.

The post will cover all the major international banks such as JP Morgan, HSBC, CitiBank, Goldman Sachs and many more. AI vendors are listed alphabetically.

Table of Contents

Arago

Leading AI software company Arago aims to help businesses, including banks, implement automation in their IT processes.

Swiss multinational UBS Group AG provides financial services and advice to clients in over 50 countries.

Since 2016 UBS has been using Arago’s AI software, in particular, their problem-solving AI platform HIRO.

Capable of automating the management of the business or IT processes.

Hiro helps to improve efficiency and operational effectiveness. UBS uses Hiro to “resolve complex IT issues in non-standardized, distributed environments” within their IT landscape.

USB is also using HIRO to identify potential issues within their system.

This enables UBS to resolve these problems before they begin to interfere with the operation of the business.

Dr. Stephan Murer, Chief Technology Officer of UBS described the implementation of HIRO as “a key step towards a new kind of process automation based on artificial intelligence. This underpins UBS’ reputation for being an innovation leader.”

MORE – Essential Enterprise AI Companies Landscape

Ayasdi

Ayasdi develops AI software with machine learning tools that provide the user with valuable data insights.

As well as being able to track events in realtime, Ayasdi’s software enables users to avoid risk, and manage inefficiencies.

It also helps users evade threats and grow resilient systems that make the most out of enterprise data.

For users in the banking sector, this enables the reduction of false positives in fraud detection processes.

It also helps to prevent money laundering.

One of the largest banks in the world, HSBC was, in 2017, connected with a worldwide money-laundering scandal.

Since then HSBC has been using Ayasdi developed AI software to automate and improve compliance checks.

The software also helps to identify unusual activity.

Andy Maguire, HSBC’s Chief Operating Officer, explained that anti-money laundering checks are something that “the whole industry has thrown a lot of bodies at because that was the way it was being done.

However, AI technology can help with compliance because it has the ability to do things human beings are not typically good at like high-frequency high volume data problems.”

By partnering with Ayasdi, HSBC benefits from Ai’s ability to identify complicated, potentially fraudulent patterns.

By processing unstructured data AI software helps HSBC to better understand their customers.

This enables the bank to better understand the risk of dealing with a potential customer.

MORE: 10 Applications of Machine Learning in Finance

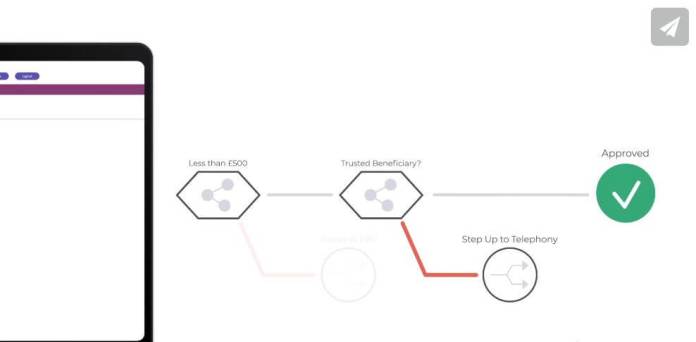

Callsign

Since 2012 Callsign has been producing AI software armed with deep learning techniques and advanced analytics.

They aim to provide robust digital identification solutions.

The company provides solutions and “bank grade” secure identification solutions to both public and private sector clients.

Traditionally regarded as one of the “big four UK banks” Lloyds Bank has been operating since 1765.

Since July 2019 Lloyds Banks has been using Callsigns digital ID and authentication solutions.

This partnership sees Lloyds using Callsigns AI platforms in all its core brands and services.

Here the technology helps Lloyds to identify and protect customer fraud, as well as enhancing the customer experience.

The CEO and Founder of Callsign, Zia Hayat said: “Our solution will enable the bank to go even further in maintaining a premium customer experience when it comes to identification, traditionally a challenging thing to achieve.”

Cloudwalk

Chinese company Cloudwalk is one of the leading developers of facial recognition software.

The company was founded in the Chongqing Institute of Green and Intelligent Technology, part of the Chinese Academy of Sciences.

Cloudwalk is believed to have a 30% market share of China’s facial recognition industry.

One of the largest state-owned Chinese commercial banks the Bank of China has been using Cloudwalk’s AI software since 2015.

Initially, the bank adopted Cloudwalks infrared anti-theft technology.

This is capable of scanning a person’s face and accurately identifying them.

It has a reported success rate of over 99%.

This technology is being used by the bank to identify illegal or fraudulent attempts to access an account.

Bank of China also uses Cloudwalk’s facial recognition AI software to allow customers to withdraw their money.

In addition to passing the facial recognition screening, the customer must also correctly enter a password.

CogniCor

Conversational AI Platform developers CogniCor use AI software to provide digital assistants for the wealth management sector.

Singapore based OCBC bank is a global provider of banking and financial services.

OCBC is using CogniCor developed AI software to power Emma, their home and loan renovation service chatbot.

After three months of training, Emma was launched.

She is able to address any possible questions a customer may have about home or renovation loans.

Emma is also able to identify and correctly interpret any terminology used during a customer loan application.

Using an internal debt servicing ratio calculator Emma is able to accurately tell a customer how much they can borrow.

Finally, Emma can be constantly updated, meaning that it stays relevant as the market or regulations change.

Comply Advantage

Comply Advantage use technical architecture, data science leveraging and machine learning to change how data is processed.

This approach is delivering results in the areas of Anti-Money Laundering and Know Your Customers (KYC)

Comply Advantage’s AI Software has already been adopted by a number of banking providers including Santander.

According to Jonathan Holman, Santander’s Head of Digital Transformation, this partnership is already delivering results.

Holman revealed that since adopting Comply Advantage AI software, “we’ve gone from twelve days mean cycle time for onboarding to two days.

We have also been able to cut process time for both customers and colleagues by more than 50% in most cases, up to 75 or 80%.”

Comply Advantage’s approach to data processing helps to make systems safer.

It also helps to improve customer service and security.

Their AI software helps users to easily integrate updates and solutions while also providing enhances customer support.

MORE – Machine Learning Startup Mimiro Raises $30M

Digital Reasoning

Nashville based Digital Reasoning uses machine learning to monitor natural-language communications, to monitor communications.

This, helping to detect fraudulent activity or insider trading, is an increasingly important role for AI software.

Digital Reasoning’s approach is already being used on Wall Street.

Here their AI software monitors the millions of emails, texts and messages sent every day.

The software is able to identify any language or behavioral patterns that are unusual, highlighting potentially troublesome activity.

When suspicious behavior is identified an alarm is raised, allowing an investigation to quickly take place.

Digital Reasoning claims their approach has helped to lower false-positive rates by between 95 and 99%.

Multinational banks such as Goldman Sachs and UBS are already benefiting from Digital Reasoning’s work.

NASDAQ is also using Digital Reasoning’s AI software to identify irregularities.

MORE – Dutch Lender ING Launches New AI Bond Trading Tool

DreamQuark

DreamQuark has developed Explainable AI. This piece of AI software aims to help financial service providers increase revenues.

It also generates new sales opportunities and allows users to better engage with their customer base.

DreamQuark’s AI software, Brain, helps companies quickly scale, train, control and implement AI within their existing structures.

François de Lescure, Chief Sales & Marketing Officer of DreamQuark explained that the “strength of Brain’s platform is its ability to generate models for different use cases for marketing but also for risk, fraud, and compliance.

As a result, our clients can generate added value for all their departments with a unique and single platform”.

Since 2018 BNP Paribas, the international wealth management group has been using the Brain software.

Here BNP Paribas is using Brain to help their Relationship Managers analyse the needs of their clients.

The information generated by Brain helps them to offer the most suitable products.

Element.AI

Leading providers of AI software and enablement tools, Element.AI helps organizations accelerate AI adoption every step of the way.

Their tools help to speed up data labeling and processing, allowing AI models to be trained quickly and efficiently.

Element.AI helps financial service providers with compliance and predicting the services that their customers will need.

Global banking giants, HSBC are using Element.AI software to conduct data analysis.

This allows the bank to predict the services that their clients may require in the future.

The AI software also helps HSBC to meet the many necessary global regulatory requirements such as anti-money laundering rules.

MORE – Element AI Launches $45m AI Fund with Korean Giants

EZOPS

EZOPS provides AI software that can check for errors as well as offering insights and potential issuers.

Their software is more reliable and quicker than relying solely on human operatives.

Financial providers require reliable data control solutions and reconciliation.

These are increasingly being provided by AI software such as EZOPS.

Global banking and investment company BNY Mellon are using EZOPS solutions to improve their service provision.

Their AI software was implemented first in BNY Mellon’s Alternative Investment Services business.

EZOPS AI software is helping BNY Mellon to better provide services that suit their customer’s complicated data needs.

As the software is rolled out BNY Mellon clients will be able to access the new possibilities.

Access will be possible through a specially designed portal.

This collaboration helps BNY Mellon to provide better customer service and self-service opportunities.

It also helps to improve automation adoption, enhancing the digital experience.

Finn.ai

Finn.ai use AI alongside sophisticated banking domain expertise to construct accessible conversational banking platforms.

These are designed for use by financial institutions, allowing their customers to quickly and easily manage their accounts.

Their tools can also be used to improve a customer’s financial literacy. Banpro is a private bank based in Nicaragua.

They are using Finn.ai software to grow their customer base by engaging with a larger section of society.

Finn.ai is also helping them to bring their banking services to their customer’s phones, making financial support easily accessible.

In Nicaragua, like many other countries, smartphones and social media are prevalent.

Banpro’s conversational assistant operates on Facebook Messenger.

This use of social media helps them to reach the widest potential customer base possible.

High Radius

Software-as-a-Service company HighRadius leverage AI-based autonomous systems.

This allows their clients the ability to automate and optimize Accounts Receivable and Treasury Processes.

The company’s Integrated Receivables platform helps to “reduce cycle time in order-to-cash” processes.

This is done by using AI software to automate payment processes across payments, electronic billing and credit processing as well as in cash application, deduction, and collection processes are also automated.

The Bank of America is an American global investment bank and financial service provider.

Bank of America is using HighRadius AI software to power its intelligent receivables.

This helps the bank to speed up receivables reconciliation for their business clients.

Intelligent receivables works by identifying payers and associating their payments to remittances.

The software can also extract remittance data from emails, payment web, and interchange portals.

Intelligent receivables also match payments to open receivables, creating a posting file that can be uploaded to an ERP system.

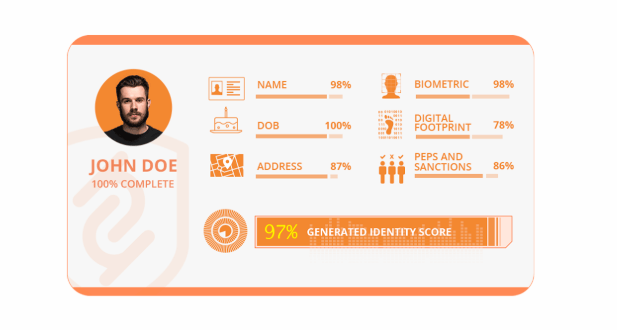

Hooyu

Hooyu was launched in 2012 by ID verification service 192.com.

Hooyu is an identity confirmation service, designed to help people to correctly verify other people’s identity in the digital age.

U.K based Natwest Bank is a major commercial and retail bank.

Natwest uses Hooyu to confirm a customer’s identity when they open an account.

This collaboration made them the first UK bank to allows customers to open an account with a selfie.

Capable of safely and quickly correctly verifying a person’s identity.

Natwest Bank uses AI-powered Hooyu software to verify a person’s identity with a selfie

Hooyu uses a combination of ID document authentication, facial biometrics, and digital footprints.

This allows Natwest to safely identify a customer.

It also allows customers to safely access their account from a range of devices.

Hooyu is TLS encrypted and once the identity check is complete all document copies are deleted.

Intelligent Voice

UK based Intelligent Voice has been providing market-leading solutions in the field of compliance since 1990.

Today they are a global leader in the development of “proactive compliance and eDiscovery technology solutions”.

These solutions can be applied to video, voice and other media and are used in a range of different industries.

In the financial industry Intelligent Voice AI software is particularly useful in the field of compliance monitoring.

ING Group is a Dutch multinational bank. Since 2015 ING Group has been working with Intelligent Voice to improve its compliance monitoring.

Alongside Relativity Trace, the proactive risk management and compliance app, ING is using Intelligent Voice.

This combination allows them to monitor the IM and email communications of almost 400 traders.

This is just the start of a major rollout. Eventually, this system will monitor the written and spoken communications of over 1200 traders from all over the world.

Kasisto

Kasisto use AI software to power a conversational platform known as KAI.

This platform can deal with both complicated corporate bank processes or wealth management issues to basic retail transactions.

Kasisto’s conversational platforms are used by a number of major financial service providers including Mastercard, JP Morgan, and DBS.

DBS Bank is a financial service provider and multinational bank based in Singapore.

KAI was used by DBS bank to launch their award-winning digibank.

This is DBS Bank’s mobile-only bank operating in Indonesia and India.

Kasisto’s conversational platform is a key part of this operation.

KAI’s AI software operates in Facebook Messenger, on websites and the bank’s own mobile app.

It allows users to ask, and receive answers to thousands of different questions.

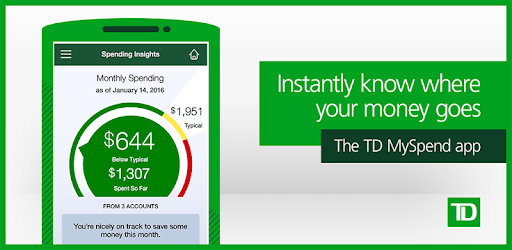

Moven

Moven Enterprise blend AI software with innovative mobile-banking technology.

This creates a platform enabling banks to cut attrition rates and customer acquisition costs while identifying and maximizing new revenue streams.

Moven provides smart banking technology that is both flexible and highly-personalized.

The aim of this approach is to help banks better engage, retain and grow customer relationships.

Westpac is an Australian banking and financial services provider.

Westpac is working with Moven to utilize data that will “enhance the customer experience”.

Westpac hopes that this partnership will help to make them a leading digital bank.

TD Bank, a subsidiary of Canadian multinational Toronto-Dominion Bank is also working with Moven.

They hope that the collaboration will help to improve their customer experience.

TD Bank’s MySpend app allows users to track their spending habits.

Users also receive real-time notifications, allowing them to always be on top of their financial situation.

The app is already proving popular.

Rizwan Khalfan, TD Banks’ chief digital officer, announced that within 9 months of launching the app had gained “850,000 registered users.”

Khalfan also revealed that customers who use the app “reduce their spending by around four to eight percent, with most frequent users seeing the greatest impact.”

NetOwl

NetOwl is a machine learning-powered AI software suite comprising of Identity and Text Analytic products.

This then analyses big data, in the form of documents or social media posting as well as structured entity data.

Canada’s largest bank, the Royal Bank of Canada is a multinational financial services provider.

The Royal Bank of Canada uses NetOwl to analyse their data for compliance monitoring.

NetOwl also provides RBC with threat monitoring and risk management purposes.

RBC also uses NetOwl’s AI software to screen potential new customers identifying people who have committed fraud in the past or who may commit fraud in the future.

This helps to safeguard the bank, and its investments, from malicious activity.

Persado

Since 2012 Persado has been using NLP and mathematical certainties to revolutionize the world of digital marketing with AI.

To put it simply, Persado use AI software to write engaging and effective advertising copy.

Persado aims to create effective copy that appeals to current customers as well as engaging new, potential consumers.

American multinational investment bank and financial services holding company JP Morgan Chase are keen to exploit this possibility.

JP Morgan Chase is working with Persado to create effective, digital marketing campaigns.

These are designed to reach millions of both current and potential customers.

During a pilot run, JP Morgan Chase reported a lift of 450% in advertising click-through rates.

MORE – JPMorgan Creates an AI-Powered Virtual Assistant to Support its Clients

MORE – JPMorgan Introduces Amazon’s Alexa to Wall Street’s Trading Floors

Personetics

A rapidly growing company, Personetics help financial institutions engage and cater for their customers in the ever-evolving digital world.

This is done by combining financial service domain expertise with AI software.

Predictive analytics, machine learning, natural language understanding capabilities, and other sophisticated tools are also employed.

This approach allows Personetics to deliver a tailored experience that allows the individual the ability to manage their finances.

Personetics have collaborated with Canadian multinational banking and financial service provider Royal Bank of Canada to deliver NOMI Budgets.

This is an AI software-based money management tool that forms part of the RBC’s mobile app.

Monitoring a user’s spending habits, NOMI Budgets recommends monthly budgets and automatically tracks their spending.

RBC also offers customers NOMI Insights, which provides personalized financial insights and advice and NOMI Find and Save.

This analyses spending habits, identifying extra money and automatically placing it in a savings account, helping the customer to save money.

Similarly, US Bank has partnered with Personetics to create a mobile app.

This app monitors user’s financial behavior, such as their spending habits.

The app also provides personalized insights and practical advice, helping customers to make smarter financial decisions.

Quantexa

Quantexa provides AI software that analyses big data to identify potential money laundering, fraud, and terrorist activities.

Standard Chartered is a UK based multinational banking and financial service provider.

Quantexa has delivered an AI software platform that enables Standard Chartered the ability to efficiently carry out complex financial investigations.

Quantexa’s intelligent AI software analyses both structured and unstructured data relating to a customer.

This allows Standard Chartered to enjoy a complete overview of their customer’s actions and intentions.

Data such as this enables the bank to make better, and quicker, informed decisions.

A holistic approach to security, enables Standard Chartered to better understand risks and trends from numerous data points around the world.

By automating the search process, Standard Chartered’s investigators are afforded more time to focus on potentially illegal activity.

Retresco

German company Retresco is pioneering innovative AI software for content automation.

Their tools power AI software that automates report generation.

Utilizing AI software and tools in this way can help a business to accelerate their digital adoption journey.

It also helps to improve the customer experience.

Universal bank Commerzbank is one of Germany’s largest financial service providers.

Since 2018 Commerzbank and Retresco have been developing an “internal enterprise platform for building and deploying chatbots”.

Of the three chatbots so far developed one is designed to aid employees who have lost keys or ID cards.

The other chatbots are concerned with purchasing, tendering and granting authorizations, optimizing the bank’s internal processes.

By quickly answering frequently asked questions employees don’t have to spend valuable time searching for the right answer.

AI software platforms allow Commerzbanks chatbots to be utilized across the entirety of their internal activities.

Commerzbank and Retresco are also working on AI software that generates the reports it regularly sends to clients.

This application of automation can help to optimize processes, allowing employees to focus on more high-value tasks.

SAS

SAS produces AI software and business intelligence tools.

Their solutions help businesses with data mining, predictive modeling, visualization and analysis reporting.

The consumer division of multinational Citigroup, Citibank, is working with SAS to develop an advanced analytics scoring engine.

This AI software gives Citibank not only more usable data but also more context in which to better understand the data.

This helps the person viewing the data to make an informed decision.

Citibank believes that this adoption of AI software will help to streamline what can be a time-consuming process.

Automation not only helps to digitize a manual process but it also helps Citibank ensure that they are regulatory compliant.

This can be particularly difficult for institutions that operate in a range of markets and countries.

AI software and automation helps to speed up this process while also removing the possibility of human error.

The global head of trade services at Citibank is Valeria Sica.

Sica believes that “This solution assists in managing and comparing a large number of data points across current and prior transactions, which will provide more context and usable data to aid the decision-maker in reviewing global trade transactions, which has traditionally been a very manual process across the industry.”

MORE – Interview: AI Fun Begins After Data Engineering

MORE – Citi Invests in AI Firm Anaconda

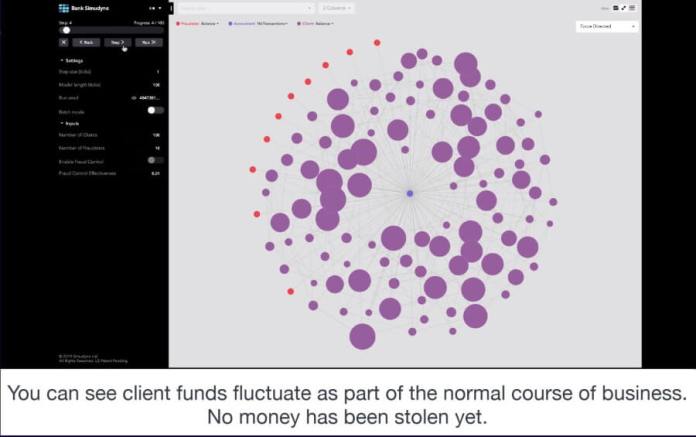

Simudyne

Enterprise software producers Simudyne produce AI software for financial institutions.

Their solutions allow financial service providers to efficiently simulate potential future scenarios in a secure, virtual environment.

Their AI software can be applied across trading, lending and risk management areas.

Barclays is a UK multinational investment banking and financial service provider.

Simudyne’s AI software allows Barclays to simulate a range of scenarios, such as modeling the actions of a fraudster.

Until now this modeling relied on extrapolating historical data and complicated, expensive simulations.

The AI software developed by Simudyne is not both flexible and robust.

It also makes better use of more data, both structured and unstructured.

Barclay’s chief risk officer CS Venkatakrishnan said that they hoped this approach would help the bank “spot and prepare for risks arising from dynamic and large, direct and contingent counter-party exposures”.

MORE – Barclays Pushing into Artificial Intelligence to Manage Risk

TigerGraph

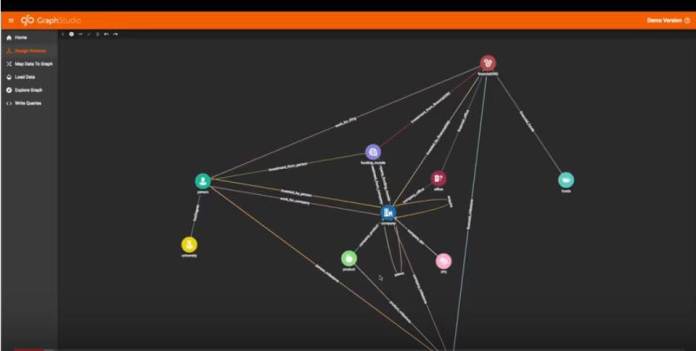

TigerGraph produces quick and scalable graph platforms.

Their TigerGraph graph platform is the next level in AI software and machine learning tools for graph databases.

TigerGraph combines features such as Massively Parallel Processing, MapReduce and fast data compression and decompression with new approaches.

Combining these features creates a scalable, quick and reliable means of deep exploration.

This allows the user to get the maximum value from their data.

TigerGraph’s tools utilize analytics, machine learning, and AI algorithms to help analyse complex data sets.

Leading financial service providers such as Visa and corporate and personal service provider China Merchant Bank use TigerGraph to enhance their fraud detection processes.

The analytic AI software provided by TigerGraph also enhances processes such as credit risk assessments.

China Merchant Bank is just one of the financial service providers using TigerGraph technology for critical tasks.

YSEOP

Natural Language Generation pioneers YSEOP aim to use automation and AI software to modernize, speed up and scale complicated workflows.

Their AI software is used by financial service providers for automated report generation.

French multinational investment bank and financial service provider, Société Générale is one institution working with YSEOP.

Alongside Addventa, YSEOP and Societe Generale have been developing AI software for automated report generation.

This has helped to reduce commentary report production time by 80%.

Utilizing AI software in this way has helped to drive improvements in operational efficiency.

It is also helping to standardize the quality of reports produced.

Applying automation here also helps to increase staff efficiency, allowing them to spend time on more high-value products.

YSEOP’s development was awarded the most innovative innovation at the 2019 digital finance awards.

As this list shows AI software and automation processes are already impacting the banking and financial sector.

From report generation and workflow optimization to enhancing security and identifying potential risks, AI software is greatly changing the banking sector.

Images: Flickr Unsplash Pixabay Wiki & Others